Who's Who on the Power Grid

When working with the power industry, you’ll come across utilities, IPPs, Co-ops, regulators, retailers, and more: this post puts them in their place.

9 minute read ∙ Apr 20th, 2020

Most people don't think about the power industry very often (unfortunate, but their loss). But when they do, they typically think about power utilities, as they are the main entities on the grid. When working in the industry you'll come across different types of utilities and many other players responsible for different parts of power delivery and regulation. This post gives an overview of the key players.

Utilities

Utilities have the biggest responsibility to deliver reliable power.

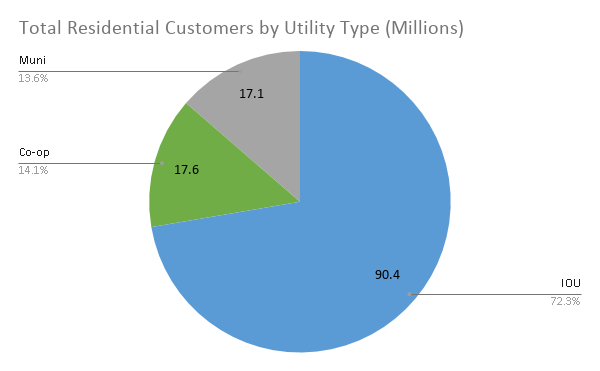

Utilities in North America come in three major flavors: IOUs, Munis and Co-ops. The EIA provides an excellent data set that allows us to get a sense for the coverage of these different types of utility.

Investor Owned Utilities (IOUs)

Investor Owned Utilities or IOUs are private, for-profit companies that are granted a monopoly to provide electricity throughout their service territory.

Some IOUs are among the largest companies in the world - as of 2019, there were 10 IOUs in the Fortune 500. IOUs tend to be much bigger than other types of utilities, and they dominate the North American electricity markets. According to the EIA, over 70% of homes in the USA are served by an IOU.

Many IOUs have a regulated arm that operates the regulated utility, and deregulated arms that operate similar businesses, such as energy service companies or independent power producers. For example, many large IOUs will have a regulated utility that operates transmission, distribution and retail, and a deregulated arm that acts as an IPP (independent power producer).

IOUs are regulated by Public Utility Commissions (PUCs), which are headed by state elected or appointed officials to oversee all utility operations. This includes approving budgets, expansion plans, rate changes, and more. In practice, the (necessary) process required to get approvals from the PUCs leads to utilities moving slowly. IOUs often have some sort of innovation budget that allows them to bypass the slow regulatory process for pilot projects - this is what most startups will tap into to get budgets for their programs. But, any large scale program will likely have to go through some sort of regulatory procedure. So beware: success in a pilot does not guarantee a large scale contract.

Municipal Utilities (Munis) and Cooperatives (Co-ops)

Munis and Co-ops are technically different but functionally have enough similarities that it is worth lumping them together for our purposes.

Municipal Utility Districts (Munis) - and the similar Public Utility Districts (PUDs) - are owned and/or operated by a city or county. Co-ops are owned by their customers. Both answer to a board of directors that are publicly appointed or elected, and both non-profits or publicly owned.

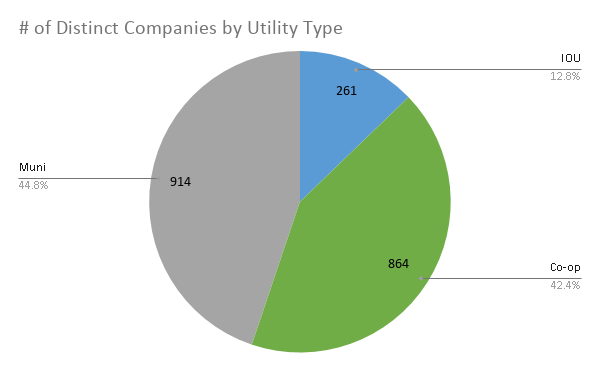

Some Munis rival IOUs in size - the biggest is LADWP in Los Angeles, which serves over 1.3 million homes. Most, however, are much smaller. Munis will typically serve a single city or urban region. Co-ops, in contrast, were originally formed as a way to electrify rural America, as the IOUs did not find it profitable to extend their power lines into sparsely populated areas. Therefore, co-ops have massive service territories but generally small populations. Despite the big difference in density, according to the EIA data set both the average muni and co-op has about 20,000 customers.

As a broad generalization, because co-ops and munis are somewhat self-regulated, they can usually move more quickly. While IOUs need to go through regulatory processes before developing programs, co-ops or munis can move relatively quickly if they decide a program is favorable for their customers. The downside is that these companies are often smaller and have fewer resources, so can be stretched quite thin if trying to take on many innovative efforts simultaneously.

Comparing types of utilities

A couple of charts from the EIA dataset show how different types of utilities compare.

This chart shows that IOUs dominate in terms of total number of customers served. Therefore, if you are selling to utilities and want to reach the mass market, you will need to sell to IOUs.

This chart shows that, even though IOUs serve the majority of customers, there are many more munis and co-ops. This reflects that the average muni and co-op has 20,000 customers, while the average IOU has 350,000.

While the IOUs have big budgets, many smaller companies have found success by first finding a willing partner in the more nimble muni and co-op space, then moving to IOUs when they achieve a certain scale.

Community Choice Aggregators

CCAs are a relatively new option on the grid that work essentially as non-competitive retailers - that is, they fulfill the role of a retailer, but are not open to free market competition. A region, typically a city or county, may set up a CCA if they decide that they no longer want to buy power from their IOU. Instead, they band together and buy energy from IPPs. The utility is still responsible for transmission and distribution, and gets paid a fair price for doing so, but they do not get paid for generation. Due to the way regulations are set up, usually customers are opted in to their local CCA by default, and have the opportunity to opt out and buy generation from their utility instead.

CCAs have been set up across portions of California and other states. The main driving force behind these CCAs to date has been a desire to buy 100% clean energy that the utility had not been willing to provide.

Deregulated players

Independent Power Producers (IPPs)

IPPs are companies that sell electricity into competitive wholesale power markets. Because they own their own power plants and are exposed to significant fluctuations in power prices, they tend to be massive companies with big balance sheets. In fact, many prominent IPPs are the deregulated parts of IOUs. Nextera Energy and Duke Energy are a couple of the biggest examples.

IPPs sell electricity into competitive markets from power plants they own. Therefore, they make money if they own a plant that can sell electricity for more than it costs to own and operate the plant. This requires operational execution to keep electricity production costs low and predictive capabilities to estimate the wholesale price of power over the lifetime of the plant.

Another model that has become relatively common as a way to promote clean energy projects is the power purchase agreement (PPA). In this type of agreement, a contract guarantees that a utility will buy a specified amount of power from the IPP over a certain time period (e.g. 10, 20, 30 years), for an agreed upon price. This lowers the risk for both the IPP and the utility, because neither will be exposed to wholesale price fluctuations.

Retailers

In competitive retail markets, retailers are the interface to the grid for their residential and commercial end customers. Customers pay their retailer for their electricity consumption, and in turn the retailer aggregates together all that consumption and buys enough power on the wholesale power market to cover them. They also pay the distribution utility for the grid infrastructure to deliver the power. According to the EIA data set, ~11% of residential homes in the USA are served by a competitive retailer. Half of those homes are in Texas, the largest competitive retail market. Other major deregulated states are Illinois, Ohio and Pennsylvania.

While there are some huge retailers that provide power to millions of residential and commercial customers, retail generally has a lower barrier to entry than generation. Because it does not deal in physical infrastructure, retail is more prone to disruption by startups than utilities or IPPs.

Griddy is an example of a retail startup that has taken market share by doing things differently. While most retailers offer a fixed $ / kWh price for electricity to their end customers and take some markup, Griddy passes through the wholesale price to their end customers and takes no margin except a flat fee of $10 / month. This means that on average customers pay less for power, but also exposes them to times when wholesale power prices are extremely high - in Texas, they can rise to 100x the average cost of power. This provides a good alternative to customers who are able to use less energy during high price times or don’t mind taking a short-term hit in exchange for long term savings.

Other important entities

Here’s a quick run down of some other important entities in the North American power landscape.

FERC and the Independent System Operators (ISOs)

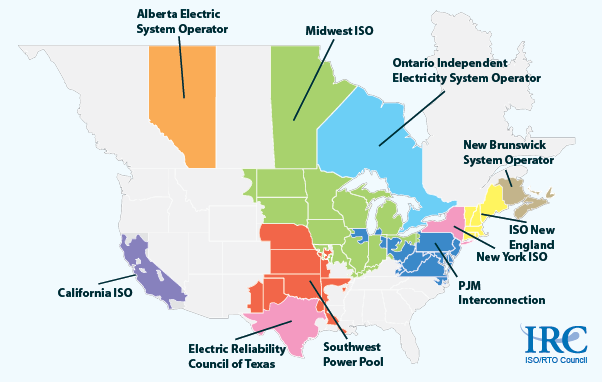

Approximately 2/3 of the North American grid are covered by Independent System operators. The ISOs are responsible for balancing the grid over massive territories, usually across multiple states. They operate all sorts of power markets, including those that govern local power prices across the grid, capacity payments for generators, and the price of ancillary services such as frequency regulation. Regional Transmission Organizations (RTOs) are technically different to ISOs but similar enough that we will group them together. Where there are no ISOs, IOUs are responsible for grid balancing and have to follow FERC rules.

In these regions, the wholesale power markets tend to be more open. End customers of a certain size are free to choose where to buy power from through Virtual Power Purchase Agreements (VPPAs), and often can offer load flexibility services into open capacity markets.

FERC, the Federal Energy Regulatory Committee, is led by 5 commissioners, who are appointed by the President. They create the rules that govern ISOs - typically, FERC will pass a ruling and then within a few years ISOs will have to incorporate that into their operations. An example of an impactful law that FERC passed recently was Order 841, which is projected to have a major impact on Energy Storage deployment because it orders the ISOs to fairly compensate Energy Storage resources for the services they provide to the grid. Similar rulings on demand response and load shifting can make or break markets, so FERC is an important entity to be aware of.

North American Electric Reliability Council (NERC)

NERC is non profit corporation responsible for maintaining the reliability and security of the power grid. Specifically, they create standards that ensure the reliability and security of the grid, then they make sure those standards are being followed and are up to date. They monitor electricity reserves, audit utilities, update rulings, give trainings, etc. They have governance over "Bulk Power System", which is everything at the Transmission level through US, Canada and parts of Mexico.

Federal Agencies: Tennessee Valley Authority (TVA) and Bonneville Power Administration (BPA)

TVA and BPA were set up during the Great Recession as a way of electrifying and providing economic development for the greater Tennessee region and the Northwest, respectively. They are Government Agencies who are responsible for Generating and Transmitting power throughout their regions, at which point local utilities handle the Distribution and Retail. While BPA’s territory has many IOUs, TVA’s distribution is almost exclusively run by munis and co-ops.

TVA and BPA are unique entities, and the chances that similar structures will be created elsewhere in the future are very slim. But, these two entities control massive amounts of resources, and play very important roles in their regions. They primarily try to keep their power reliable and cheap, but they do play a role in pushing forward innovation through pilot programs. However, beyond pilot programs they move very slowly; if you don’t have resources to be patient, proceed with caution.

Public Utility Commissions (PUC)

PUCs are the very important state bodies that are responsible for regulating utilities - not just power, but water, gas, and any other relevant bodies. Their primary purpose is to oversee utility operations - essentially making sure utilities spend money responsibly. More spending leads to higher rates so, because utilities are not subject to market forces, the PUC provides discipline in that area.

PUCs are operated by a group of commissioners, who are either voted in or appointed by state government officials. The staff of the PUC is relatively stable, but there is often a fair amount of cross pollination between PUC staff and IOU staff. So, utilities and their PUCs tend to have simultaneously friendly and testy relationships.

Research institutes - EPRI, National Labs, SEPA, etc.

Many non profit or governmental research institutes play important roles in pushing power grid technology forward. Utilities often favor non profits for their research projects, and these research institutes are often the beneficiaries of that in of terms getting innovative pilot projects funded. They frequently pioneer hardware development or publish open source software tools to help drive grid innovation.

There are too many to list here, but EPRI as well as the various national labs are the most prominent in this group, and SEPA is a leader on the energy transition. For example, OpenADR (a load shifting protocol) was originally developed by Lawrence Berkeley National Lab.

Media

There is a lot of general interest in clean energy, so many mainstream publications cover relevant topics. However, here are a few good options offering consistent coverage:

Utility Dive is my most consistent source for utility related news. Their weekly newsletters are worth signing up for to stay on top of various regulatory filings, product releases and more. They have enough content to keep you busy.

Greentech Media is another excellent source with a focus on clean energy, although its free content has slowed slightly in the last couple of years after they were acquired and focused more on research, paid content and conferences. Their articles and podcasts are still highly recommended.

Energy Central has a number of topic specific boards where people can post articles or publish their own.

Interested in learning more?

Sign up for our quarterly(ish) newsletter with industry & protocol news, commentary and product updates.

Or if you'd like to discuss, contact us